Prince Bank enhancing cashless banking to support customers and businesses

The Covid-19 pandemic has spurred digital adoption across the board among all demographic segments in Cambodia, particularly for digital natives – the young adults who use smartphones in every aspect of their daily lives. To reduce the risk of infection, people started to avoid going out and began relying on digital platforms for everyday living, such as for shopping online, using delivery services, working from home, and managing and accessing their finances remotely.

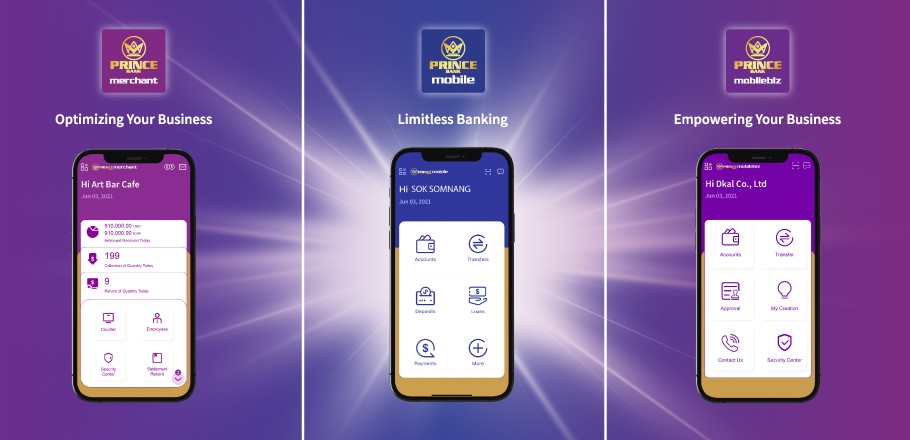

As the fastest growing digital bank in the country, Prince Bank has wide-ranging capabilities for digital banking, including mobile banking, digital payments, ATMs and CDMs, to deliver the best quality services to customers, all within a convenient and secure system.

The current pandemic has been tough for the many people who do not have digital banking apps on their mobile phone. They need physical cash for their daily payments while it carries a risk of infection through the handling of banknotes. Cashless payments will be much easier when one has Prince Mobile. It can help one with daily financial management, cashless payments and the transferring of money securely and seamlessly.

Customers can routinely access their accounts and also perform multiple transactions digitally, such as opening a new account, applying for a new Mastercard/Visa virtual or physical card, or to make top-up term deposits, QR payments, bill payments, local funds transfers via NCS, Retail Pay, FAST and Bakong, and loan enquiries, among many other features.

Customers will receive a real-time notification regarding all bill payments or transactions they have made throughout the day, with the specific time, date and place for both card and QR payments.

With more than 5,000 merchants across the nation in the marketplace, our customers can make cashless payments with ease by using Prince Pay and can even enjoy special cashback of up to $30 per month.

What is even more special for the next release of Prince Mobile – which will be coming soon in July – the Prince eAccount and special account number request will be available.

The Prince eAccount is an electronic banking account that allows a new customer to immediately open a bank account with Prince Bank remotely through the Prince Mobile app. The customer can receive and transfer funds instantly within the bank and to local banks, perform bill and QR payments, and enjoy a wide range of promotions from Prince Bank too. Another brand new key feature of this new release is the special account number. This feature allows customers to personalise their account numbers with their own choices without having to step into a branch. It can be any special number that they wish to have for their account.

With the new release, the bank will also launch Prince Rewards Points on Prince Mobile, where customers can get reward points for banking transactions and referring friends to sign up for Prince Mobile. You can redeem these reward points on the phone top-up feature on Prince Mobile, and with Prince Pay merchants.

PRINCE Mobilebiz® and PRINCE Merchant® are the upcoming business banking apps that Prince Bank aims to extend the digital support to its business customers and partners. With the technologically advanced & secured digital capability & user experience, these soon to be release apps will surely support these business owners to control their daily business transaction more efficiently and conveniently. These apps will be soon available for both iOS and Android mobile devices.

To find out more about Prince Bank’s products and promotions, please contact 1800 20 8888.